So You Want To Crowdfund Your Startup App?

If you’re a developer, you know how hard funding and traction are to come by. Most software startups try crowdfunding and fail — they’re doing it wrong! To crowdfund your app, and supercharge your business, let’s look at what works, what doesn’t, and get started right!

It’s no secret that the crowdfunding industry is booming. It seems like every day you hear about an exciting new startup crushing their campaign goals and launching their company via Kickstarter or Indiegogo.

Despite the rapid growth of crowdfunding platforms and campaign successes, crowdfunding is still a foreign concept to most. As such, let’s briefly explain the mechanics and guidelines for a more solid foundation before exploring launching a software startup with crowdfunding.

What Is Crowdfunding?

In its simplest form, crowdfunding is getting others to finance the creation of a product, project, business or work of art. It’s extremely advantageous for entrepreneurs and eliminates the overbearing upfront costs that stop most startups before they begin.

Today Kickstarter and Indiegogo are the unquestionable champs of rewards-based product crowdfunding (though many other donation, charity and investment platforms also exist). It feels like a good number (stats unfortunately unavailable) of startup successes and cool crowdfunded products you hear about began here. But if it sounds too good to be true, there’s often more to the story.

Background And Context

Crowdfunding did not begin as a prelaunch product platform. Indiegogo, the first major crowdfunding site was set up to promote arts and creative endeavors. Launched in 2008, Indiegogo (or IGG) led the way in empowering independent film projects. Kickstarter followed suit the following year.

What began primarily as platforms for “starving artists” to finance creative pursuits, quickly grew and evolved as entrepreneurs and product creators started to take note. And the success has been impressive. Today Kickstarter startups have raised over $1,756,706,971; though much less transparent and recent, as of October 2013, Indiegogo creators had funded over $99,000,000. Based on the growth of its site and numerous campaign successes, one can only assume Indiegogo has grown to a comparable size with Kickstarter.

Why Has Crowdfunding Been So Successful?

With the advance and expansion of e-commerce, which now accounts for 7% of all consumer retail according to US census data, individuals are shopping locally less, now being able to buy anything with the click of a button. This has democratized the consumer–business relationship because customers have a far greater choice.

With the power to choose, consumers are opting more for small startups and more personal connections. Hence the explosion of crowdfunding. Furthermore, backers prefer to be early adopters, people who get the product first and are actively part of the startup’s success. In addition, entrepreneurs who were once unable or unwilling to pursue financing can now cut the risk and crowdfund instead.

Why Do Apps And Software Struggle

As a crowdfunding consultant and host of Art of the Kickstart, a podcast and blog on all things crowdfunding, one thing I get asked about incessantly are crowdfunded apps. Many of social startups and mobile apps companies raise massive outside investment looking to change the world and result in stock market launches (initial public offerings or IPOs) or acquisitions down the road.

Despite these successes, most people would be hard pressed to name a single crowdfunded app. Personally, I’d never heard of a successful crowdfunded app before performing in-depth market research for my first app client. Such apps are rare. But why?

Crowdfunding seems the perfect platform to launch an app or software product. Unfortunately, non-tangible products are poorly received. This stems from the origins of crowdfunding, because crowdfunding was originally conceived as helping creative people create that which could never exist without funding. For example, films have inescapable budgets, and physical products need molds, manufacturing and expensive minimums. Neither is possible without significant startup funds. However, apps and software are the exact opposite. Time and expertise are all that is necessary, inventory costs are zero and there is funding aplenty for those willing to part with equity.

Crowdfunding For App Entrepreneurs

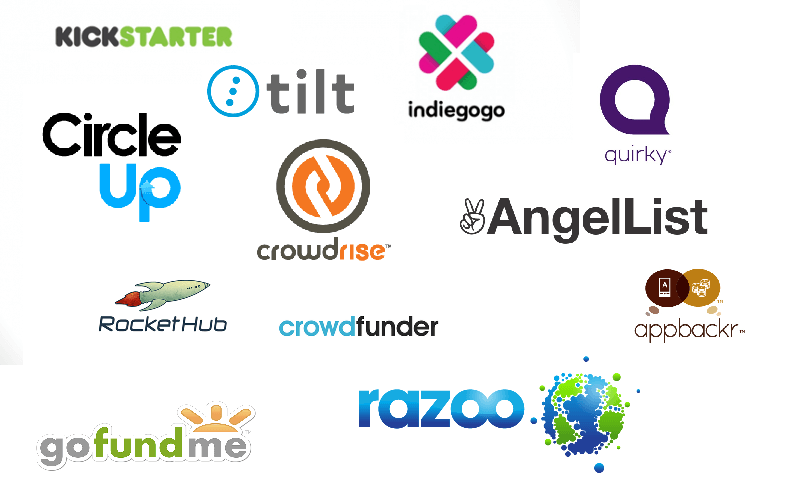

Assuming you’ve already decided to crowdfund your app, it only makes sense to maximize your chances. Part of that is understanding and choosing the proper platform. To do that, it helps to know the crowdfunding eco-system. And there are three very different approaches here: donations, equity, and rewards-based crowdfunding — each obviously with pros and cons.

Charitable Campaigns

First let’s cover charitable campaigns; the ones that fight to make a difference. For apps and ideas along these lines, sites like GoFundMe, Razoo and CrowdRise are powerful donor platforms without investor or backer obligation that allow individuals to raise funds to pursue a passion or change the world. Understand, however, that their less stringent, open-to-anyone nature presents charitable sites as a less reputable and professional funding route (typically much less successful as well) and as such have not yielded any successfully funded app startups to my knowledge.

Equity Crowdfunding

Equity crowdfunding is an inevitable source of funding growth in the coming years (see the Jumpstart Our Business Startups (JOBS) Act). In equity crowdfunding the backers get a bit of the business. Equity platforms like AngelList, CircleUp and Crowdfunder are global networks connecting investors with entrepreneurs who need cash (imagine a small scale IPO). Unlike traditional venture capital however, smaller stakes are offered and founders often retain control of the business direction unimpeded.

Unfortunately, lack of significant investor commitment leads to less attention and help, and fewer connections common with traditional venture capital. And most equity crowdfunding efforts require more traction and a stronger track record to receive legitimate interest and funding opportunities. For larger, more established software startups like Dash, however, which recently raised $1.5 million on AngelList, equity crowdfunding can present a powerful tool to quickly expand.

Rewards-Based Crowdfunding

Finally the rewards-based crowdfunding, the picture most of us paint when thinking of crowdfunding. These operate as businesses have for centuries, but with a preorder twist. In a nutshell, startups “presell” products to fund product production. Though many rewards-based crowdfunding sites exist like Quirky, RocketHub, AppBackr and Tilt exist, we’ll focus on Kickstarter and Indiegogo, as these are the largest and most successful when it comes to products and business. Although both serve similar functions and have a great deal in common, there are several key differences worth noting.

Types Of Campaigns

One of the biggest differences between Kickstarter and Indiegogo are the types of campaigns. Kickstarter projects have set goals and falling short means a no-go on funding. Indiegogo offers both this and flexible funding, a campaign setup where founders receive funds either way and have the ability to extend projects beyond original deadlines.

There are pros and cons to each. While flexibility is always nice and continued campaigns increase funding and exposure, the urgency of do-or-die deadlines usually leads to bigger successes.

Success Rates

Kickstarter is pretty open with its stats while Indiegogo unfortunately is not. To date, 37.8% of all Kickstarter campaigns succeed. It’s worth noting that only 21.26% of tech projects get funded. While lack of data makes it challenging to analyze, experience and scraped stats from late 2013 suggest a lower success rate and smaller average funding for IGG creators.

Gender

Indiegogo is more diverse than Kickstarter. For projects and apps targeting female users, this is important to note. Research indicates only about 22–30% of Kickstarter users are female as opposed to 42–50% for IGG. Apps or products focused on female audiences should keep this in mind.

Expectations And End Products

Indiegogo is less restrictive than Kickstarter. For creators this means fewer rules and regulations to slow you down. For instance, Kickstarter requires creators to showcase product prototypes where applicable while IGG does not. With this, campaigns on Kickstarter are typically more polished and the products more finalized, making Indiegogo more favorable for some earlier stage startups.

You Can’t Kill Two Birds With One Stone: Focus On Users Or Funding

Software startups have a hard time crowdfunding for all the reasons mentioned. To make it easier and get the most out of your campaign, consider your primary objective: funding or users.

Most apps are driven by user metrics: more users, more engagement. That’s all that matters for ads, venture capital and potential acquisitions. For these companies, exponential growth and exposure are all the startup needs and funding is just added bonus — treat it as such.

Low campaign goals mean virtually assured success; that is, free publicity and small reward tiers make it easier for backers to justify supporting you. Both encourage the all-important user growth you were looking for anyway.

Unfortunately, most app founders set themselves up for failure by aiming at both large funding totals and lots of users simultaneously. It is crowdfunding though, and as a software startup there are some ways to still fund the company.

Strategies To Increase Funding

Increase Perceived Value

Once created, software is extremely cost-effective to scale. With the exception of some hosting, technology and back-end costs, apps and software as a service (SaaS) products are almost infinitely scalable and cost little to maintain or distribute on a per user basis. To overcome this in the eyes of backers and be able to charge more for the product, it’s important to add value (whether real or perceived).

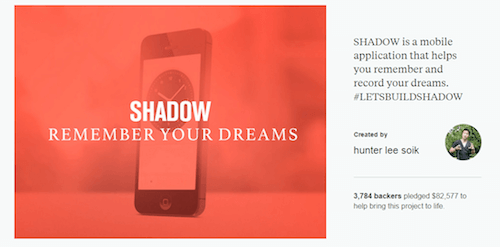

One tech startup that provides the perfect example and created impressive crowdfunding success is SHADOW | Community of Dreamers. Its creators managed to raise $82,577 from 3,784 backers. SHADOW overcame app-based crowdfunding challenges for its sleep and dream tracking software by adding a level of exclusivity to the rewards and project.

While the app would normally be free, when bundled with an official SHADOW community member card (that is, a little exclusivity), the price rose to $8 and brought in nearly $20k from this tier alone.

Offer Related Rewards

Another strategy crowdfunders use to maximize campaign dollars are additional (ideally related) rewards. Note that T-shirts are overdone, unpopular and typically do little for a campaign’s success — your brand isn’t established or attractive yet. Instead of throwing unrelated rewards or branded memorabilia into your campaign, consider related upsells and complementary products. These add value to reward tiers and increase pricing, all of which help a campaign fund.

When possible, non-physical products make the best add-ons. There are no shipping or product costs so it’s all profit. And the SHADOW dream team did a great job with this. By bundling the app with ebooks (or physical copies) on the topics of sleep, mindfulness and dreams, they were able to charge more, better engage backers and raise over $10k, or roughly 13% of the campaign’s total funds in the process.

Early Beta Access

Most crowdfunders and Kickstarter backers are early adopters by nature and always want to be first. Software startups with legitimate, standalone value can take advantage of this.

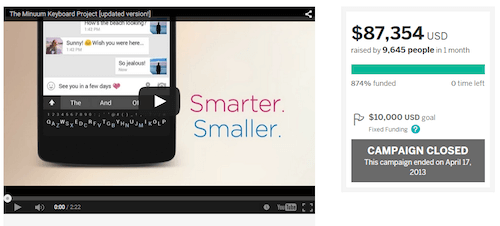

Launched on Indiegogo in March 2013, Minuum was a cool Android keyboard that helped users save space on smartphone screens. The campaign exploded, raising $87,354 with 9,645 backers all interested in a better mobile experience now.

With a $5 beta access reward, Minuum managed to raise over $40k and amassed a sizable user base before even launching. This is the power of relieving a legitimate pain point, and a useful strategy for similarly focused startups.

Leverage An Audience

The easiest way to launch any business is to appeal to existing fans or customers. Once trust has been established and value added, the pitch or the sale becomes easy. It’s because of this and the ranking algorithms behind both major crowdfunding sites that building a launch or mailing list is a must. The faster you fund, the higher rank, the more exposure, the more sales.

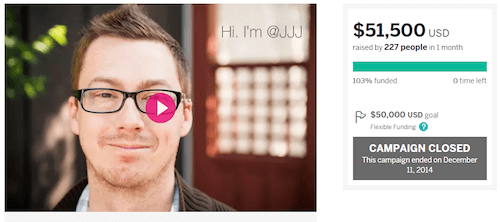

One highly original yet effective example of an audience-focused software campaign was John Jacoby’s WordPress sister projects, launched at the end of 2014. John’s goal was “to make it possible for me to volunteer full-time for 6 months on three sister projects to WordPress: BuddyPress, bbPress, and GlotPress. The focus will be solely on their continued maintenance, ongoing development, and evangelism.”

John successfully raised just over his $50k goal from 227 loyal and dedicated backers. Due to the nature of the project, the rewards weren’t particularly attractive. Instead they built on his authority and reputation in the WordPress community, leveraging his blog and experience as a speaker with two ultra-high tiers, $5k and $10k respectively, that made up the bulk of his funding. For founders with existing audiences or expertise this can be a powerful approach.

Don’t have an audience or time to build one? This is not ideal, but it is not a problem. Get influencers on board for reviews and testimonials, or even in advisory roles, and use their prestige to push and vet the product.

Offer Long-Term Value At A Steal

SaaS (think Salesforce, Basecamp, GoToMeeting and so on) is a great business model to be in: everyone loves recurring revenue. But getting these startups off the ground typically takes more upfront cash and offers fewer opportunities for outside funding. Here crowdfunding can potentially be the solution, given demand and marketing success.

At least that’s what Ghost, the rebooted blogging platform and CMS, proved with its 5,236 backers and £196,362 Kickstarter success. By combining early VIP access with extended service hosting, something that bloggers and site owners would need anyway, Ghost elevated the immediate value of its already desirable software and raised over £106k from these alone. By sacrificing a little on long-term profits, Ghost saw significant short-term gains and backer support, leading to the startup cash needed to proceed.

But, of course, that was not all. There’s more than meets the eye to crowdfunded success and maximizing funding. To go deeper you’ll need to understand and explore crowdfunding more to set your startup up for success.

Final Thoughts

The rapid growth and success of crowdfunding is only going to continue. Up to this point most software startups have failed to take advantage of this growing movement.

Throughout this article we’ve covered the highs and lows of app-based crowdfunding, the purpose being to shed light on common software flaws seen in crowdfunding to ideally help your campaigns prosper. And whether you choose to use crowdfunding to jump-start your startup or not, many of these concepts go well beyond initial launch-stage success. Audience, exclusivity, increased value — these are the tools on which you build a business.

Considering crowdfunding? A backer yourself? I’ll be active in the comments below to respond to any thoughts, questions or experiences you may have on the subject.

Crowdfunding Resources

To go beyond the scope of this article and explore additional tools and tactics to successfully crowdfund your cool new app startup, here are some invaluable places to get started.

- Art of the Kickstart: an extensive podcast and blog on all things crowdfunding. Get the six-step mini course.

- CrowdCrux: a powerful resource for crowdfunders looking to raise funds.

- Hacking Kickstarter: a detailed post on Tim Ferriss’ 4-Hour blog with 80⁄20 principles to crowdfunding.

And, of course, start spending some time scoping out the crowdfunding scene. You will be amazed by what you see, what you learn, and how embedding yourself within the community creates opportunities for success for your own startup down the line.

Further Reading

- Current Trends And Future Prospects Of The Mobile App Market

- How To Start An Open-Source Project

- The Art Of Launching An App: A Case Study

- How To Build Strong Customer Relationships For User Research

Register!

Register!

Flexible CMS. Headless & API 1st

Flexible CMS. Headless & API 1st